SR Homes Now Selling New Cumming Homes at Chimney Creek

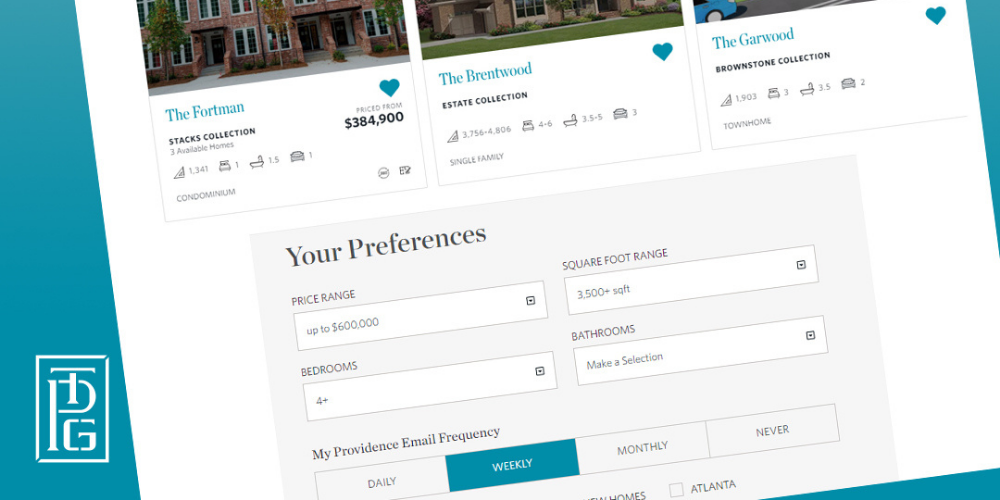

Top Atlanta home builder SR Homes recently opened for sales at its latest collection of new Cumming homes at Chimney Creek. Priced from the low […]

SR Homes Now Selling New Cumming Homes at Chimney Creek Read More »